Many people are used to setting aside money each month for college, unexpected medical bills, and even vehicle maintenance. But what about a natural or man-made disaster? Are you financially prepared to provide basic needs such as food, water, clothing and lodging for you, your family, and your pets for days, weeks, maybe even months? Below is a guide to get you on the road to financial preparedness today.

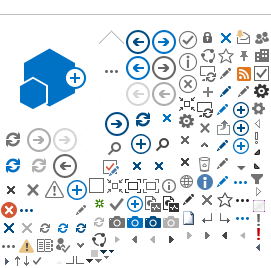

Complete an

Emergency Financial First Aid Kit (EFFAK) now!

- An EFFAK will help ensure you and your loved ones are protected during and after a disaster.

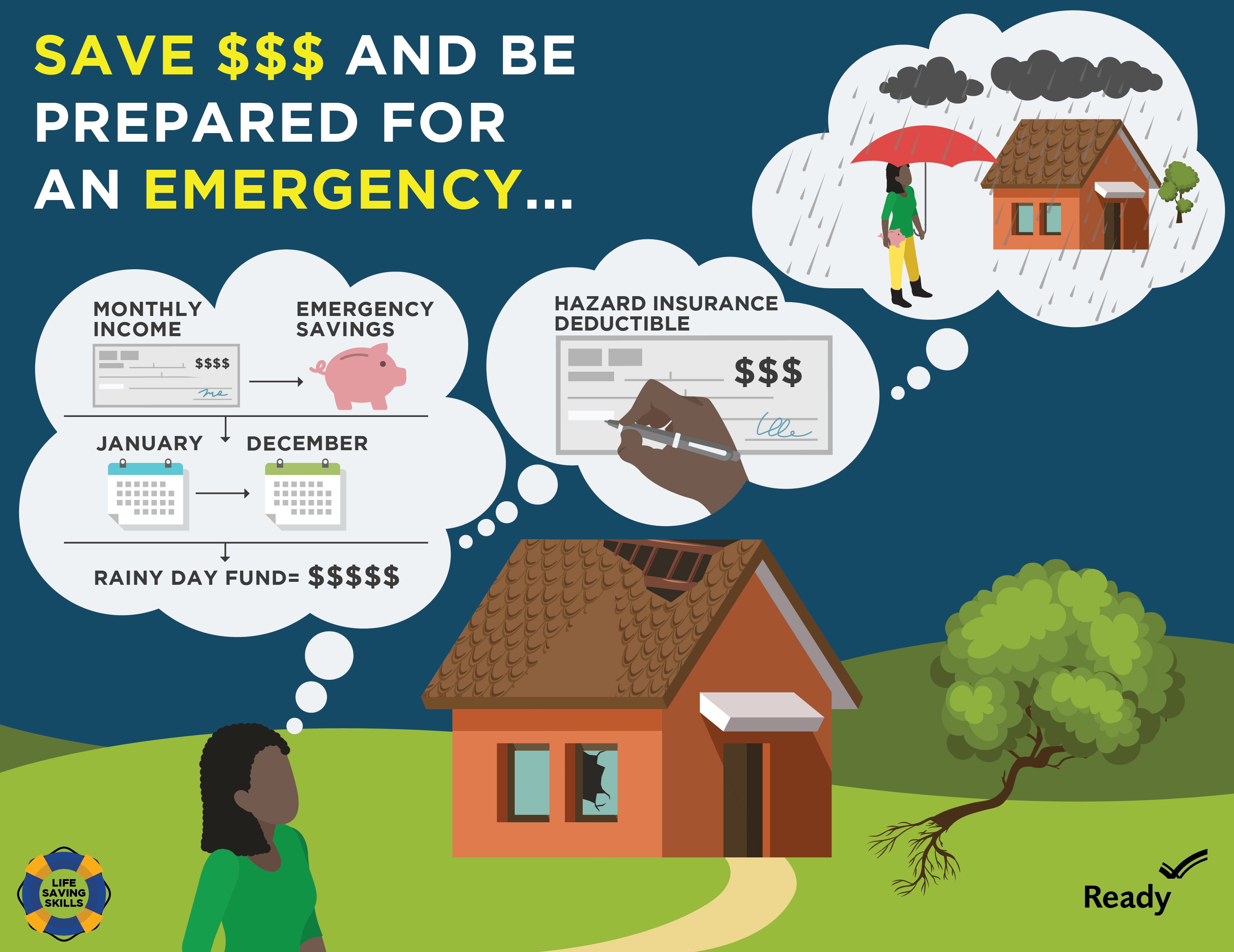

Have Access to Cash

- Put away money each payday into an emergency savings account.

- Keep a small amount of cash at home in a safe place. Banks may close and ATMs and credit cards may not work during a disaster.

- Enroll in direct deposit, or request pre-paid debit cards, instead of being paid with paper checks.

- Enroll in auto pay for bills, or at least be prepared to pay online.

- Contact your bank, lender, and other financial institutions now to determine if they have any options to postponed payment in the event of a disaster.

Protect Important Documents

- Save hard copies of financial, critical personal, household, and medical information in a fireproof and waterproof container.

- Save soft copies of these documents to the cloud to ensure access from alternate locations.

- Consider making these documents accessible on the cloud to family members or friends outside your disaster area in the event you are without internet access.

Insure Your Future

- Obtain property (flood, homeowners, or renters), health, and life insurance if you do not have them.

- Review existing policies to ensure the amount and extent of coverage is right for you and your family for all possible hazards.

- Homeowners insurance does not typically cover flooding, so you may need to purchase flood insurance from the National Flood Insurance Program.

Warning!

- Most flood insurance policies take about 30 days to go into effect.

- Experts say you should have between three and six months' worth of living expenses in your emergency fund.

- According to the Federal Reserve, 40% of American's don't have $400 in savings.

Additional Resources

any people are used to setting aside money each month for college, unexpected medical bills, and even vehicle maintenance. But what about a natural or man-made disaster? Are you financially prepared to provide basic needs, such as food, water, clothing and lodging for you, your family, and your pets for days, weeks, maybe even months? Below is a guide to get you on the road to financial preparedness today.

Emergency Financial First Aid Kit (EFFAK) now!

An EFFAK will help ensure you and your loved ones are protected during and after a disaster.

Have Access to Cash

Put away money each payday into an emergency savings account.

Keep a small amount of cash at home in a safe place. Banks may close and ATMs and credit cards may not work during a disaster.

Enroll in direct deposit, or request pre-paid debit cards, instead of being paid with paper checks.

Enroll in auto pay for bills, or at least be prepared to pay online.

Contact your bank, lender, and other financial institutions now to determine if they have any options to postponed payment in the event of a disaster.

Protect Important Documents

Save hard copies of financial, critical personal, household, and medical information in a fireproof and waterproof container.

Save soft copies of these documents to the cloud to ensure access from alternate locations.

Consider making these documents accessible on the cloud to family members or friends outside your disaster area in the event you are without internet access.

Insure Your Future

Obtain property (flood, homeowners, or renters), health, and life insurance if you do not have them.

Review existing policies to ensure the amount and extent of coverage is right for you and your family for all possible hazards.

Homeowners insurance does not typically cover flooding, so you may need to purchase flood insurance from the National Flood Insurance Program.

Warning!

Most flood insurance policies take about 30 days to go into effect.

Experts say you should have between three and six months’ worth of living expenses in your emergency fund.

According to the Federal Reserve, 40% of American’s don’t have $400 in savings.

Additional Resources

Ready.gov:

Financial Preparedness

USA.gov:

PrepTalks